Malaysia Residential Property Market Analysis 2025: Poised for a Transformative Year

Key Takeaways

- Economic Shift: Rising demand, urbanization, and post-pandemic recovery are repositioning Malaysia’s residential market for 2025.

- Tech and Green Integration: Buyers prefer smart and sustainable homes, significantly impacting developer planning.

- Investor Appeal: Strategic location within ASEAN, rising buyer sentiment, and government support enhance investment prospects.

A Look in the Rear-View Mirror: Pricing Trends and Historical Performance

Malaysia’s real residential property prices have historically seen periods of stable growth and brief downturns connected with economic instability, particularly during the global pandemic years1.

Prices adjusted for inflation experienced a decline in some urban areas but began recovering from 2021 as the market regrouped with renewed urban migration and stabilized macroeconomic conditions2.

Key Market Drivers: Urbanization, Infrastructure, and Demographics

Rapid urban growth is pushing developers to focus on metro regions with integrated facilities, while infrastructure enhancements such as MRT3 Circle Line and Pan Borneo Highway are advancing suburban connectivity3.

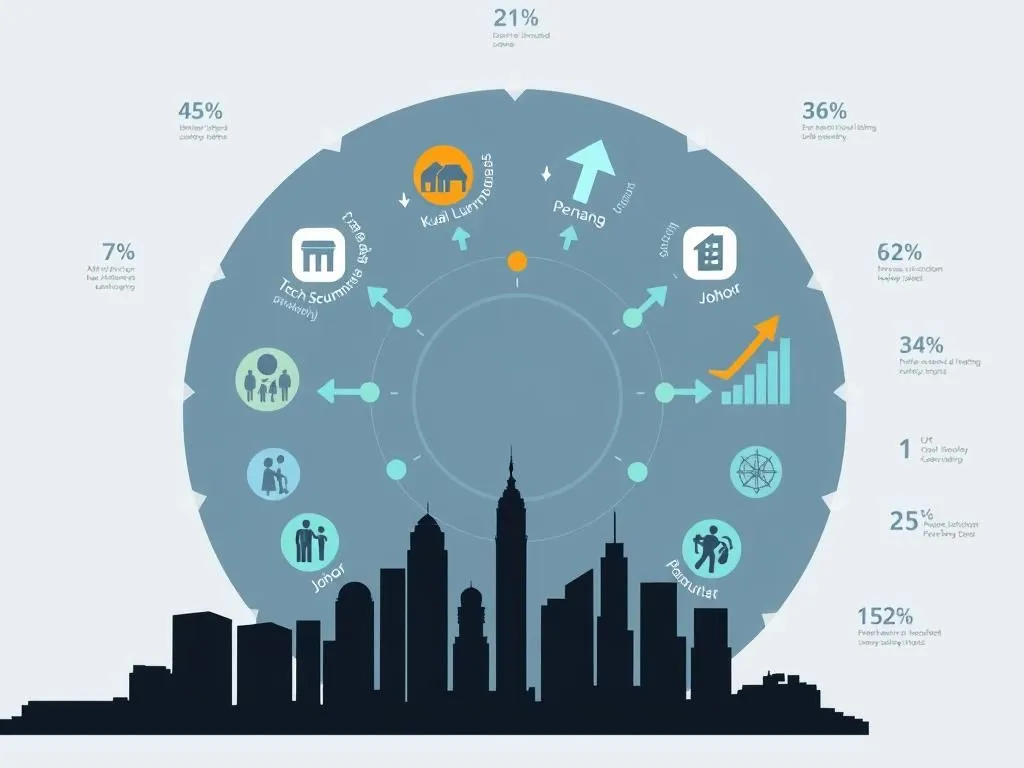

General overview of market trends across key locations, highlighting buyer activity and project launches across progressive corridors.

A Regional Power Player in Southeast Asia’s Real Estate Scene

Malaysia’s cost advantage and regional access make it a prime target for international funds and private buyers seeking growth potential in Southeast Asia4.

Forecasting Resilience: 2025 and Beyond

Despite global shocks, Malaysia’s housing ecosystem is showing resilience, with developers leaning into design diversity, affordability, and sustainable builds5.

Advanced market modeling points toward growing strength in green-labelled, lifestyle-rich and micro-segmented housing types suited for post-pandemic behavioral shifts6.

The Buyer Experience: What Home Seekers Want in 2025

Younger buyers are increasingly selecting compact, connected units with amenities and digital readiness as standard features7.

Platform tools have enhanced property match-making with filters for lifestyle, transit, and energy preferences8.

Environmental Red Flags: Building for Climate Resilience

Heightened flood risks and climate impact challenges are fueling demand for eco-engineered solutions and strategic elevation planning in development proposals9.

AI-driven platforms boost property insurance models by enhancing resilience risk scoring and allowing better disaster-response architecture10.

Segmenting the Market: Tailored Solutions for Diverse Buyer Groups

Malaysian housing now spans luxury high-rises, co-living formats, and affordable landed units. Strategic segmentation is helping match product to market efficiently11.

Long-Term Outlook: Looking Ahead Through 2033

Smart city implementation and AI-led home lending models are forecast to raise housing demand and investment maturity through 203312.

The Current Pulse: What 2024’s Mid-Year Review Tells Us

Mid-2024 saw moderate revival in transaction counts, sharper resale competitiveness, and heightened interest in niche suburban developments13.

Frequently Asked Questions

Question: What types of homes are in highest demand in 2025?

Answer: Compact, transit-connected units with energy efficiency and smart-home features are leading buyer priorities.

Question: Are foreign buyers showing renewed interest in Malaysia?

Answer: Yes, due to pricing advantages and government-friendly policies, Malaysia is attracting investors from neighboring ASEAN countries and beyond.

Question: How is technology impacting residential property design?

Answer: Tech is influencing everything from unit layout to predictive maintenance systems, as buyers expect more automation and sustainability features integrated into their homes.

Disclaimer: The information is provided for general information only. JYMS Properties makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.